Healthcare revenue cycle management (RCM) faces ever-mounting challenges—rising denial rates, growing inefficiencies, and evolving compliance risks—all threatening financial viability and contributing to poor patient outcomes. As RCM depends on a series of increasingly complex, interdependent workflows and the siloed approaches of the past are failing.

Providers need a one-stop, fully integrated solution that drives efficiency across interdependent workflows, minimizes human errors, and stays in

lock-step with regulatory protocols. The best step forward is a solution that leverages human clinical expertise in tandem with AI technology to solve for the many costs of RCM complexity.

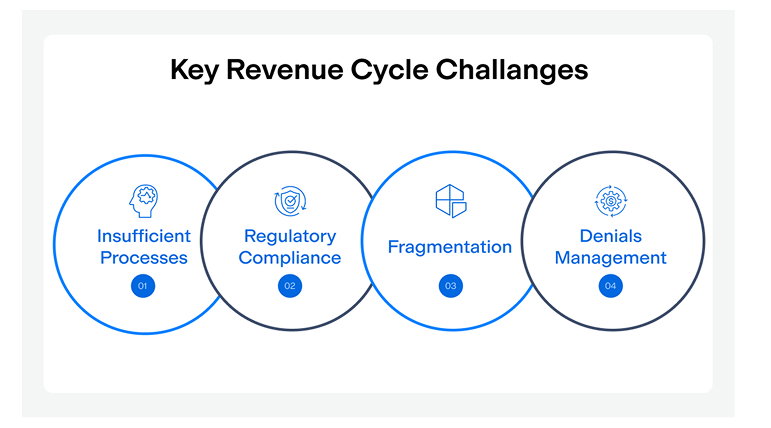

Key Revenue Cycle Challenges

Onpoint Iris is an easy-to-integrate, safety-first platform that optimizes workflows across the full continuum of patient care. Our platform is an efficiency engine built to help providers and operators re-focus on what they do best. Bridging custom-built technology, generative AI, and true clinical and operational expertise, Iris relieves the administrative frustrations with enhanced safety protocols regarding all patient data, clinical information, and documentation.

Iris’s comprehensive capabilities drive a synergistic wave of efficiency and productivity across the entire patient journey (see Exhibit below).

1.1. Inefficient Processes

Many organizations still rely on outdated practices, leading to inefficiencies in billing and collections. Manual processes and lack of automation can delay billing, claims processing, and collections. This can result in delayed claims submission and increased denial rates. Recent studies show denials are one of the top concerns for healthcare organizations posing a not only serious, but an expensive problem. According to Healthcare Finance and the new State of Claims report from Experian, denial rates have steadily increased significantly to as high as 10 to 15%.

1.2. Regulatory Compliance

Healthcare regulations are constantly changing, making it challenging for organizations to stay compliant. Non-compliance can lead to financial penalties and reputational damage. One of the many priorities for healthcare organizations is to keep up with compliance and guidelines changes to avoid improper payments and even recoupments. In recent years, it has become critical for providers to create a complete clinical note for services rendered, ensure services are properly authorized by payer, coded and billed accurately and timely.

According to CMS, Medicare 2023 fee-for-service rates were improperly reimbursed to the tune of $31.2B, or 7.38%. This is relevant because this is $7.38B worth of claims that need further adjudication by providers and healthcare organizations. This includes both over- and under payments which cause significant operational inefficiencies within the revenue cycle process. When payers give notice of a recoupment event, revenue cycle staff have to go back through each claim included in the project that is impacted and compile a case articulating why those payments are accurate. In the event of under-payments, organizations need to closely monitor payment rates by payer to quickly address any payment issues experienced by the payer and correct the process on their end. This is easier said than done.

1.3. Fragmentation

Most healthcare providers rely on a patchwork of systems for various RCM functions, leading to data silos and communication breakdowns. Manual processes, disconnected tools, and siloed workflows will impact revenue cycle performance leading to financial losses, operational inefficiencies and poor patient satisfaction. The magic happens when organizations integrate technology solutions that connect the different stages of the revenue cycle, such as pre-charting, ambient AI note creation, referral and authorization management, billing, coding, and collections.

Another key step to consider is establishing and monitoring key performance indicators (KPIs) to track the efficiency of the revenue cycle and make necessary improvements. It is critical to continually monitor not only gross and net collection rates, but also scrubber and EDI edit rates, clean claim rates, first and second pass denial rates. Understanding these metrics and what drives the performance can pinpoint where inefficiencies and issues reside in the revenue cycle process.

1.4. Denials Management

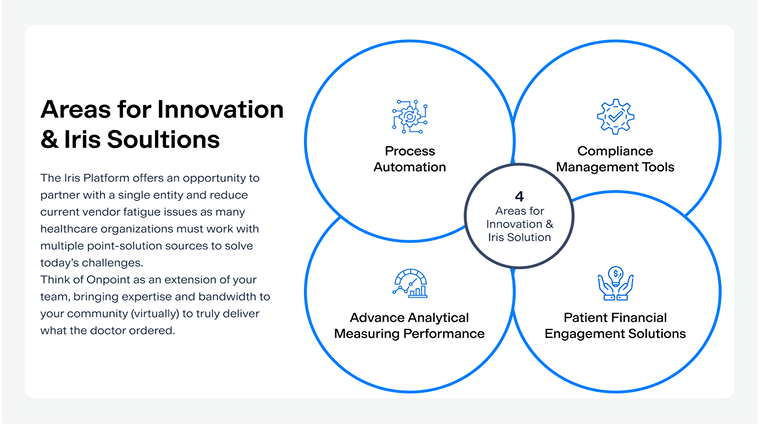

The Iris Platform offers an opportunity to partner with a single entity and reduce current vendor fatigue issues as many healthcare organizations must work with multiple point-solution sources to solve today’s challenges. Managing vendors, let alone internal staff, can be difficult and also increases opportunities for error across multiple handoffs. Onpoint becomes your dedicated partner and a part of your organization’s DNA at multiple points across your clinical and financial operations. Think of Onpoint as an extension of your team, bringing expertise and bandwidth to your community (virtually) to truly deliver what the doctor ordered.

Areas for Innovation & Iris Solutions

Claim denials significantly impact revenue. Understanding the reasons driving denials and managing them effectively is crucial for financial success. Recent reports indicate that payers are increasingly using AI to manage claims resulting in a higher number of denials and delayed reimbursement. This poses a disadvantage to healthcare providers as there is no real transparency to the AI algorithms utilized by payers. To address this issue, many healthcare providers, including health systems, are harnessing the power of AI. According to a recent HFMA survey, “Nearly two-thirds of healthcare organizations plan to increase spending on AI in the next three years, and 42% say AI-driven revenue cycle management is a top area of focus. That’s due to the big investments health plans have made in AI. Private payers could save roughly 7% to 9% of their total costs, amounting to $80 billion to $110 billion in annual savings, within the next five years.”

2.1. Process Automation

Claim denials significantly impact revenue. Understanding the reasons driving denials and managing them effectively is crucial for financial success. Recent reports indicate that payers are increasingly using AI to manage claims resulting in a higher number of denials and delayed reimbursement. This poses a disadvantage to healthcare providers as there is no real transparency to the AI algorithms utilized by payers. To address this issue, many healthcare providers, including health systems, are harnessing the power of AI. According to a recent HFMA survey, “Nearly two-thirds of healthcare organizations plan to increase spending on AI in the next three years, and 42% say AI-driven revenue cycle management is a top area of focus. That’s due to the big investments health plans have made in AI. Private payers could save roughly 7% to 9% of their total costs, amounting to $80 billion to $110 billion in annual savings, within the next five years.”

Clinical Notation

Adding ambient AI note curation and coding into clinical and administrative workflows to improve billing performance is an option that is increasingly being implemented throughout the healthcare industry, with 14% of physicians reporting using AI scribes for clinical note creation. IRIS Note leverages real clinician expertise and AI to curate clinical notes with 98.7% accuracy through ambient listening. The finished clinical note posted into the EHR incorporating the providers templates and preferences. Lastly, all data is reviewed by clinician experts to ensure accuracy and cohesiveness of the visit for the provider’s signature.

Prior Authorization and Referral Management

Prior authorization and referral management are significant obstacles to reimbursement of services rendered by healthcare providers. A survey by the American Medical Association in 2023 revealed that 94% of physicians said prior authorizations cause care delays, and 78% said they can lead patients to abandon treatment. Nearly 25% said a prior authorization has led to a “serious adverse event” for one of their patients, and 13% said it has caused a “life-threatening event” or necessitated an intervention to “prevent permanent impairment or damage.”

Iris Referral automates prior authorizations and referral management, achieving up to a 70% reduction in administrative workloads.

IRIS Referral is an end-to-end referral and prior authorization management solution that leverages technology to identify the most appropriate specialist or facility, coordinate the scheduling of the visit and close the process loop. The specialist or facility where patients are directed can be prioritized by cost, quality, proximity to the patient’s home, preferred language, etc. Iris Referral also automates the manual process of requesting prior authorizations from the payers. Through a combination of technology and services, the solution is built based on payer requirements to ensure services are approved prior to the patient visit. Automation of these processes will reduce the referral leakage rates, improve patient care, reduce appointment cancellations due to lack of prior authorization, and achieve up to 70% reduction in this administrative task.

Medical Coding

Billing errors specific to coding result in delayed or lost revenue. Implementing automated systems for billing and coding can streamline processes, reduce errors, and accelerate claims submission. Iris Code offers a proactive approach to identifying and correcting errors prior to claims submission. Through enhanced coding and charge capture, the clinical documentation is analyzed to propose precise medical codes, reducing the risk of under or over coding, and at the same time ensuring the appropriate coverage for billable services.

2.2. Compliance Management Tools

Organizations need software solutions designed for compliance to stay in lock-step with regulations. These tools can also aid in auditing and reporting, reducing the risk of non-compliance. Coupling AI note curation technology with autonomous coding ensures that accurate clinical notes are captured and accurately coded.

Credentialing compliance tools are also critical to ensure that claims are paid quickly. With federal, state, and commercial payers having different credentialing cycles, keeping track of payer recredentialing, facility privileging, medical licenses, and DEA licenses is critical for denial reduction. Not only can this impact reimbursement, but it can also evolve into hefty patient dissatisfaction if they are being impacted by out of network benefits.

2.3. Patient Financial Engagement Solutions

Investing in technology that enhances patient engagement, such as online payment portals and clear billing statements, can improve patient satisfaction and increase collections. One process that can’t be overlooked and is becoming increasingly utilized by payers is medication authorizations. The dramatic spike in medications requiring authorization has become such an issue that 10 states passed legislation to expedite patient care and reduce this burden. Onpoint Post combines medical assistants and AI technology to provide tremendous value to organizations by facilitating medication authorization activities

2.4. Advanced Analytics and Measuring Performance

Leveraging data analytics can help organizations identify patterns in claim denials, allowing for targeted strategies to reduce them. Depending on the type of facility and their specific goals, it is crucial to understand industry benchmarks and how these are measured against your organization’s performance. A few important Key Performance Indicators (KPI) to track and measure the organization’s financial performance include:

- Clean Claim Ratio

- Point of Service

- Collections

- Days in Accounts receivables

- Net Collection Percentage/Rate (NCR)

IRIS Echo’s advanced analytics and dashboards can provide the essential for monitoring and optimizing the financial processes to drive the organization to financial success. This proactive approach can improve cash flow and reduce administrative costs.

Conclusion

Prioritizing revenue cycle management is a mandatory strategic initiative. Embracing innovative solutions and leveraging technology is a crucial step forward for operational and financial health. Healthcare leaders who invest in technology that proactively adopts best practices will be better positioned to navigate challenges and earn long-term success in an increasingly competitive landscape.

Finding the right partner that offers a comprehensive suite of services encompassing the complete RCM process– patient registration, insurance verification, prior authorization and referrals, charge capture, note creation, claims submission, denials management, reporting and analytics–is the safest way to move forward with precision and make a substantial organizational impact. This is how we survive and then thrive into the future of healthcare.

About the Author

Elizabeth Feliciano, VP of Revenue Cycle Operations with over 25 years of experience leading physician and hospital-based revenue cycle operations.

Christopher Franklin, SVP and Market Leader with years of management, consulting and operations experience.

Contact Information

For further inquiries or collaboration opportunities, please contact info@onpointhealthcarepartners.com

References

- https://www.healthcarefinancenews.com/news/claims-denials-rise-complicating-revenue-collection-survey-finds

- https://www.techtarget.com/revcyclemanagement/news/366600324/Claim-Denials-Pose-Expensive-Problem-for-Providers

- https://www.hfma.org/revenue-cycle/denials-management/health-systems-start-to-fight-back-against-ai-powered-robots-driving-denial-rates-higher/

- https://www.ama-assn.org/

- https://www.cms.gov/newsroom/fact-sheets/fiscal-year-2023-improper-payments-fact-sheet

- https://www.fiercehealthcare.com/ai-and-machine-learning/most-doctors-have-not-yet-tried-ai-are-cautiously-optimistic-about-benefits